Why one housing CEO is betting Gen Z and millennials would rather rent homes than buy them

Why one housing CEO is betting Gen Z and millennials would rather rent homes than buy them

Despite the spike in interest rates, CEO John Isakson of ARK Homes for Rent has big plans to expand.

Want more stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, daily ResiClub newsletter.

While speaking to ResiClub this week, ARK Homes for Rent CEO John Isakson made a bold claim: Despite spiked interest rates, his company plans to go from 4,200 built-to-rent homes to between 25,000 to 30,000 homes across the Southeast over the next four to six years.

“I was brought in to grow the platform, to institutionalize it, and to get it to a point where it is a leading player in the [housing] market both from a size standpoint as well as a results standpoint,” Isakson, who took over at ARK Homes for Rent in December, tells ResiClub.

Alongside the 4,200 homes currently owned and in operation across the Southeast, ARK Homes for Rent has an additional 1,000 units under development and under contract. These units consist of single-family homes or attached townhomes in built-to-rent communities, with the largest markets located in Atlanta, Charlotte, Raleigh, Orlando, and Tampa.

“What I think the built-to-rent industry—and the single-family rental industry to a lesser degree—is doing is filling this void that has been created by this millennial cohort that has come along and said ‘I want to be a renter for longer, but now I want to live in a home [instead of an apartment],’” Isakson tells ResiClub.

Why is Isakson bullish on the build-to-rent sector? First, shifting demographics reveal that younger generations are opting to rent longer, he says. Second, there is not enough supply of single-family/townhome rentals to meet demand. Third, buying a home today comes at a premium monthly cost relative to renting for first-time buyers. Finally, Isakson says, the economics of build-to-rent is better than scattered home buying because it’s logistically easier to deal with maintenance and turnover when the rentals are clustered together.

Before joining ARK Homes for Rent, Isakson served as the CFO of Preferred Apartment Communities, which was sold to Blackstone in June 2022 for $5.8 billion. During his tenure, he observed demographic shifts that were further fueling the build-to-rent boom.

In Isakson’s view, some millennials and Gen Zers, who witnessed their parents or friends’ parents suffer from the 2008 housing crash and Great Recession, now see homes as “less of an asset and more of a liability.” This shifted mindset, along with lifestyle changes such as delaying marriage and parenthood (or choosing not to pursue them at all), and placing a higher value on flexibility, has resulted in increased demand for single-family home rentals.

“There is a premium to owning a home, not a discount,” says Isakson. “The discount is renting right now. When you want flexibility and you want affordability, both of those things come in a rental home. It’s easy to understand why the demand [for build-to-rent single-family/townhomes] has been so strong.”

Not long after interest rates spiked in 2022, investment pouring into the residential and commercial space slowed down.

However, despite the tightening, Isakson, whose father is the late former Georgia U.S. Senator Johnny Isakson, asserts that there’s still “an appetite” to put more capital into build-to-rent players capable of delivering results.

Properties owned by ARK Homes for Rent are either attached townhomes or detached single-family homes in the Southeast, with three-bedrooms and around 1,400 to 1,500 square-feet. The rent has a wide range across Southeast markets, anywhere from $1,500 to $3,000 per month.

If a home buyer were to purchase the same type of home today, the monthly payment for those homes could be $500 to $1,000 higher.

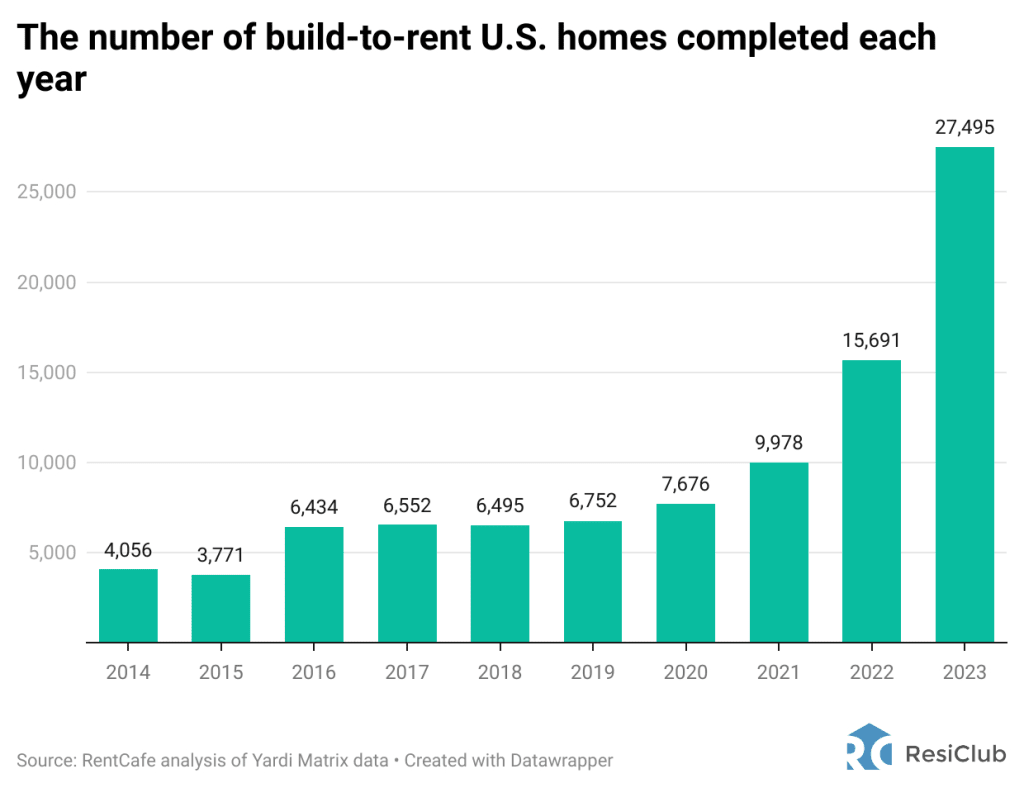

According to a report published on Thursday by RentCafe, which utilized data from its sister company Yardi Matrix, there were a record-breaking 27,495 build-to-rent homes completed in 2023, marking a 75% increase from 2022 and a staggering 307% increase since pre-pandemic deliveries in 2019.

Additionally, there’s a pipeline of at least another 45,400 build-to-rent homes expected to be delivered in 2024, 2025, or 2026.

If ARK Homes for Rent gets anywhere close to its goal of owning 25,000 to 30,000 build-to-rent homes and deploying $3 billion in capital into the space, that pipeline could expand much further.

“Homebuilders are really benefiting from it—D.R. Horton wants to build 100,000-120,000 homes per year, do they care particularly if the buyer lives there or rents it out? No. Are they happy to sell entire communities to one buyer and shorten their capital cycle? That’s a great investment for them,” says Isakson.

ABOUT THE AUTHOR

(15)