Will automatic riding Kill The Auto insurance coverage industry?

When there are no extra accidents, will there be no more Geico commercials?

could 7, 2015

in the future, robots and artificial intelligence may get rid of hundreds of thousands of jobs in america, even in industries that aren’t straight away glaring. A study not way back from two Oxford university lecturers found that forty seven% of positions are susceptible to computerization over the subsequent 20 years.

Robots are more likely to take jobs away from people because they may be more cost-effective than people and extra efficient, but additionally as a result of they will obviate the necessity for services that prop up and offer protection to humans. Why have human resources experts in case you don’t rent human tools? Why purchase insurance coverage if automation makes accidents a long way much less likely?

that is why so many individuals think the insurance coverage business might undergo within the age of evolved AI—specifically the auto insurance coverage trade.

“in fact, if it’s a safer manner of riding, it can be good for society and it’s dangerous for our insurance coverage industry,” Warren Buffett said lately when requested about the effect of automated automobiles (AVs) on his Geico subsidiary. “the rest that cuts accidents by 30%, forty%, 50% could be glorious, however we would not be holding a celebration at our insurance coverage company.”

actually, some estimates are larger than that. Google forecasts that its driverless pods might in the end stop ninety% of all accidents, whereas at the similar time taking many automobiles off the road (as a result of we will have more sharing of automobiles, slightly than everyone having their very own car). Others have speculated that premiums can be lowered seventy five%, particularly if drivers are not required to get explicit coverage, and legal responsibility shifts from drivers to manufacturers and expertise companies.

How speedy might that happen? In a contemporary document, McKinsey estimated the trade could start between 2023 and 2037. “Insurers might be required to shift their primary purpose from protecting personal shoppers from possibility tied to ‘human error’ to covering [manufacturers] and mobility suppliers in opposition to ‘technical failure,'” it said.

The U.S. nationwide highway traffic security Administration (NHTSA) carves auto-automation into stages, starting with “function-specific automation” (degree one), which contains cruise keep an eye on and automated braking, which have been around for some time. subsequent comes degree two, which incorporates adaptive cruise keep watch over, forward collision warnings, lane centering and drowsy driver detection, which can be all starting to appear now. After that, we’ve got stage three, is the place drivers on occasion totally cede control of autos in most excellent conditions, and level four, the place the auto takes over utterly always.

A %analysis predicts these stage two applied sciences will see a 15% reduction in claims for bodily damage, a 6% lower in collision claims and a 14% drop in property safety claims over two decades, nevertheless it calls its projections “conservative.”

in the brief time period, the level of accidents may just lower, however they may grow to be extra severe and extra pricey, says Jeff Blecher, senior VP of strategy at Agero, which sells automobile knowledge methods to automobile-makers. He expects degree 2 automation to reduce the incidence of front-on collisions, side-swipes and hobbies fender-benders. (The accident rate is already falling in late-model automobiles). but advanced controls might also lead to poorer driving, such that after we do need to react, we’re much less just right at it.

“consider the everyday driver and the quantity of coaching they get and what occurs as their abilities atrophy because 95% of the time they are in truth now not driving with these programs, however they only need to power when it can be exhausting,” Blecher says. “The frequency might go down, but the accidents might be worse.” And since the vehicles incorporate extra equipment on the factors where crashes are seemingly, they might cost extra to repair than they do lately, making the general impact to insurance coverage claims one thing of a wash.

The more exciting question is what occurs when absolutely automated automobiles develop into adopted—something Blecher says could start going down in about 10 years. A Rand organisation document remaining 12 months speculated that drivers would possibly duvet themselves with medical insurance and house owner’s liability insurance, and now not see the point of specific car insurance coverage. in spite of everything, we don’t purchase devoted insurance coverage for many of what we do in existence, say to journey a bicycle. And more to the point, it’s possible that automobile thefts will transform considerably much less tricky than they are nowadays. one day, all vehicles will most certainly be geared up with monitoring and disabling know-how, so that hot-wiring your neighbor’s Mercedes will likely be quite a bit less enjoyable.

the big query, says Blecher, is the extent to which manufacturers will in fact need to have full automation. If they’ll be held accountable for crashes sooner or later, it is doubtless they will need either very evolved know-how first or some kind of additional safety under the regulation. within the mid-’70s, when airbags started to appear, some manufacturers resisted putting in them as a result of they feared being held liable in the event that they failed to work. manufacturers could do the identical now with full vehicle automation. the biggest barriers to fill AVs might not be know-how or infrastructure, however moderately liability concerns. it is going to take the time to control how that is going to work, particularly as courts and officials have little prior proof to work with.

taking a look beforehand to the center of the century, many consultants predict now not most effective the belief of insurance to vary, but in addition the conception of automotive possession to vary. Google and Uber see us sharing automobiles, hailing them after we want them. And, curiously, that may well be a good factor for manufacturers too, as it may assist them avoid liability extra simply.

“by means of doing so, manufacturers might be able to use contract regulation to limit their legal responsibility and [have] better keep an eye on the best way their merchandise are used,” the Rand document says.

there are such a large amount of moving parts to the way forward for autos that it can be not possible to foretell. however it appears possible that greater automation and higher sharing will harm the basic insurance variation and put reasonably just a few folks out of work. “The insurance corporations are nonetheless going to be round, but their industry fashions are indubitably going to must adapt,” Blecher says. That sounds like a real understatement.

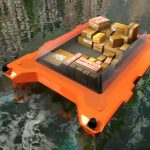

[Top Photo: Google]

(163)