Amazon and digital commerce top traditional retailers in satisfaction scores

However most “internet retailers” in the study also operate brick-and-mortar stores.

Last week, the American Customer Satisfaction Index (ACSI) released its latest Retail and Consumer Shipping Report. Based on more than 85,000 consumer surveys, the study looks at satisfaction in a range of retail categories: department and discount stores, specialty retailers, drug stores, supermarkets, internet retail and gas stations.

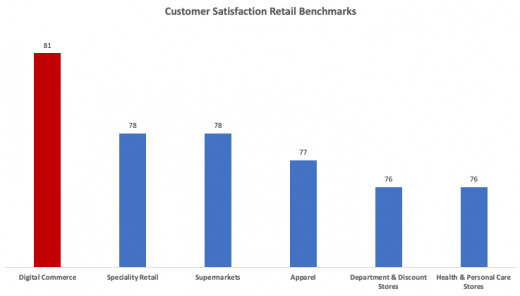

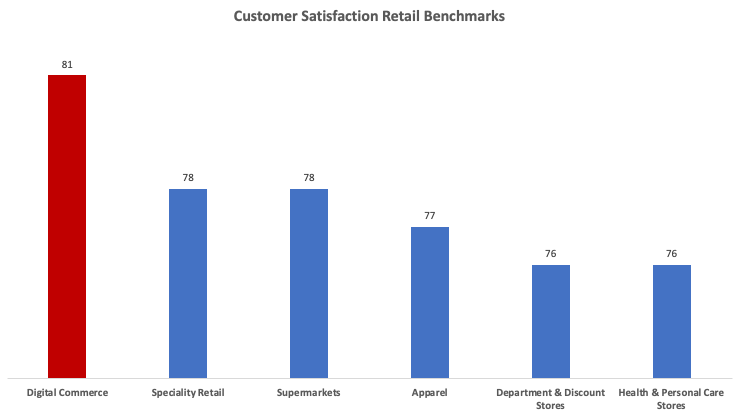

Costco and Amazon tied. Amazon and Costco tied for highest satisfaction scores, topping all others on the list. But “internet retail” (digital commerce) as a category beat traditional retail in overall customer satisfaction. This makes intuitive sense, given that consumers have shifted more of their shopping online because of convenience and the often lackluster quality of in-store retail experiences.

The survey found “no improvement among the brick-and-mortar categories,” but did observe however that “the customer satisfaction bleeding for traditional retailers has stopped.” By comparison, there was year-over-year improvement for digital commerce, reflecting “a much stronger level of customer satisfaction overall.”

Most online retailers also brick-and-mortar. The top 10 digital retailers on the ACSI list were the following:

- Amazon (83)

- Etsy (82)

- Nordstrom (82)

- Costco (81)

- HP Store (81)

- Kohl’s (81)

- Newegg (81)

- Nike (81)

- Macy’s (80)

- Wayfair (80)

Most of the stores on the full list are omnichannel sellers that have both e-commerce and traditional stores. Indeed, only a third of the retailers were digital commerce only. No DTC brands were included in the survey.

People like mobile retail apps. The top two things that e-commerce shoppers liked about the digital commerce experience were “ease of checkout and payment process” and “quality of mobile app.” The things most liked about traditional department and discount stores were “convenience of store hours,” “quality of mobile app” and “reliability of mobile app.” The latter two have little to do with the in-store experience (except in cases were there’s a “store mode”). In the specialty retail category, consumers most appreciated “convenience of store hours,” “courtesy and helpfulness of staff” and “layout and cleanliness of store.”

Why we care. The familiar e-commerce vs. traditional retail narrative (embodied in the report) has now almost fully run its course. There are really three major “constituencies” in retail: online pure plays, traditional retailers increasingly emphasizing online or omnichannel and DTC, many of which are moving from online-only to having stores (see, e.g., Casper).

While the industry wants to look at retailing through a digital or traditional lens, consumers are most concerned about convenience, price, and service. They’re less focused on whether they buy something online or offline than they are gaining confidence about the product and having an easy return process if it doesn’t work out. All this means there will be very few online-only retailers that survive over time. By the same token, traditional retailers that don’t meet consumer expectations (online and in-store) won’t be around much longer either.

Marketing Land – Internet Marketing News, Strategies & Tips

(17)