Data: Walmart wins holiday store visits, Sears’ failure is likely JCPenney and Kohl’s gain

Mobile location data reveal shopping patterns and competitive insights that marketers can exploit.

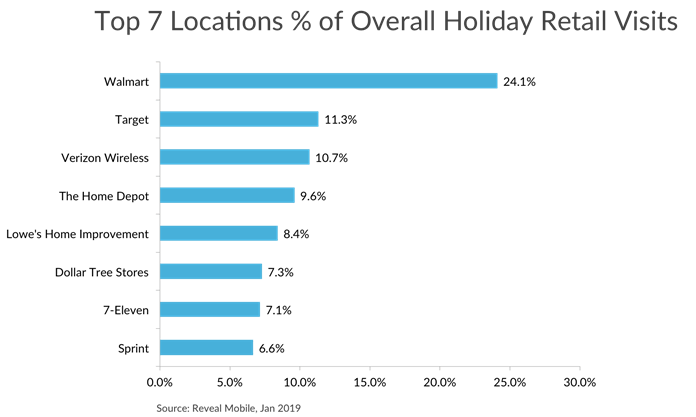

Over the holiday shopping period a surprisingly small number of retailers dominated store visits. According to Reveal Mobile, roughly one out of three U.S. shoppers visited Walmart or Target between November 12 and December 31, 2018.

Walmart saw almost 25 percent of all store visits. According to the company’s mobile-location data, nearly 90 percent (86 percent) of total retail store visits during the period were monopolized by Walmart, Target and a few others.

Unsurprisingly, embattled retailer Sears isn’t on this list. Kmart, which is also owned by Sears Holdings, didn’t make the cut either. Sears and Kmart may yet survive. But the parent company decided to close more than 140 stores last October and another roughly 40 in Q1 2019.

They benefit if Sears goes under. Using a store-visitation methodology similar to Reveal Mobile’s, location analytics company Placed found there are some clear potential beneficiaries to Sears and Kmart store closures. Placed said there was “roughly 19-25 percent” overlap in Q4 among the shoppers at Sears, Kmart, JCPenney and Kohl’s. Accordingly, as Sears and Kmart close locations, JCPenney and Kohl’s should see more visits.

Dollar Tree and Dollar General will benefit from Kmart closures, in particular. The discount chains have a 37 percent and 24 percent customer overlap with Kmart. Big Lots and Five Below may also pick up abandoned Kmart shoppers.

Some of Sears’ specialty product shoppers, according to Placed, will head to Best Buy (27 percent overlap), Victoria’s Secret (20 percent overlap) and Finish Line.

Why you should care. The marketers subscribing to location intelligence services are using the data primarily for offline attribution. However, there are a wide range of use cases beyond this. Brands and marketers historically relied on surveys to understand customers and their affinity for competitors. Those survey data, because they’re sampled and self-reported, may not be entirely accurate or representative.

By comparison, location data offers near real-time insights into consumer behavior. It gives marketers the opportunity to more clearly identify audience segments and to do a better job of reaching them. For example, Sears and Kmart competitors should be aggressively targeting those shoppers with paid (local) search and display ads — yet it’s not happening.

Marketing Land – Internet Marketing News, Strategies & Tips

(16)