The Future Of DoorDash Is Turning Delivery Into A Platform

In the technology industry, it’s exceedingly rare for any company to describe what it does simply by…describing what it does. Almost always, there’s a higher calling and a mission that goes out of its way not to sound mundane.

So it’s no shocker that DoorDash, a startup that seemingly devotes itself to delivering meals from restaurants, doesn’t call itself a meal-delivery startup. Instead, its website rhapsodizes about “streamlining the world’s cities” and “delivering smiles.”

That’s more lyrical than emphasizing the transport of edibles, but it also happens to be an accurate indication of the company’s ambitions. At its core, DoorDash is indeed about urban logistics—the streamlining of cities of which it speaks—and it delivers meals because its cofounders saw that as the most obvious opportunity when they were forming the company in 2013.

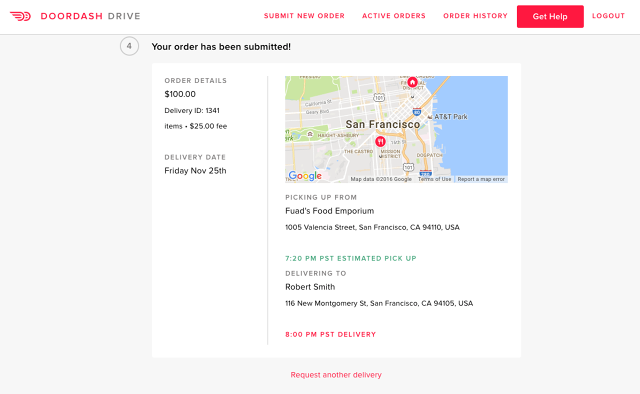

And now it’s going beyond the meal deliveries with a new offering called DoorDash Drive. Instead of an individual instigating a delivery by ordering a meal, Drive is a business-to-business service. A restaurant can request a pickup and specify where it should be taken.

DoorDash Drive, especially in its initial incarnation, is not a truly radical departure from DoorDash’s efforts to date. After all, it involves the delivery of food. But in this case, the food in question isn’t lunch or dinner for one person or a family. Instead, it’s large orders such as caterered meals or even products for retail sale.

“With DoorDash Drive, we’re building the first logistics layer for restaurants, to solve deliveries that may or may not originate on the DoorDash marketplace,” says DoorDash cofounder and CEO Tony Xu—who, with his energetic demeanor and upswept hair, gives off a vibe of being in purposeful motion even when he’s sitting in a conference room at the company’s headquarters in San Francisco’s SOMA neighborhood. “A lot of times, an off-premise order, whether it’s takeout or delivery, doesn’t necessarily happen through an app. It happens over the telephone or in person. A merchant may want to fulfill those deliveries, and so why can’t there be a way for them to do that?”

By giving DoorDash a potentially large business that isn’t just another service catering to the cravings of hungry people who own smartphones, Drive could help DoorDash stand out in the field of on-demand startups that offer, in one form or another, “Uber for food”—companies such as Postmates, Square’s Caviar, Sprig, Maple, Munchery, and even Uber itself with its UberEATS app. And it will prep the company for the day when it might start delivering things you can’t eat or drink.

DoorDash hatched plans for Drive this past summer. In the fall, it began testing it in five markets with partners such as the Buca di Beppo and Lemonade restaurant chains. Today, it’s officially bringing the service to the 250 cities in 28 markets in the U.S. and Canada where it currently operates.

Getting Chow From Point A to Point B

The delivery of meals is hardly a new business, but it remains surprisingly immature given how long it’s existed. As part of the research that led to the creation of DoorDash, Xu and his cofounders—all of whom were Stanford students—ferried items for some of the biggest names in delivery, including Domino’s. “They do about 2 1/2 million deliveries a day,” says Xu. “That’s a lot of pizza they’re moving. But if you talk to their head of delivery, that person would tell you that even Domino’s has a hard time getting it right. Either they have too many drivers, or too few. If Stanford throws a midterm, all of a sudden wait times go to three hours.”

After getting their startup up and running, at first only in their own collegiate neighborhood of Palo Alto, the budding entrepreneurs performed all the deliveries themselves for months. But they did their heaviest lifting in front of computers, creating not only a smartphone app and website for ordering but also the nebulous back-end technology necessary to efficiently route a gaggle of delivery people—”Dashers,” in DoorDash lingo—between restaurants and homes.

“Our Dashers can accept or reject orders at will, and so it’s a very hard matching problem, mathematically speaking,” says Xu. “Then you also have peak demand with lunch or dinner. And how long does it take to make things? How well do bicycles go up hills, how fast will cars traverse downtown San Francisco? All of these questions make the problem very, very difficult.”

As it chipped away at such challenges, DoorDash boomed. Millions of deliveries later, having built all that infrastructure—including both technology and on-call Dashers—the company began looking at additional ways to put it to use. That led to the creation of DoorDash Drive.

The focus on catering grew out of discussions that DoorDash had with restaurant proprietors. It turned out that their ability to make the most of this business opportunity wasn’t constrained by their ability to prepare food in giant batches.

“A lot of our restaurants had large catering businesses and many, many clients,” says DoorDash Drive product manager Abhay Sukumaran, who adds that major tech companies such as Facebook and Google order in a lot of eats. “What they were doing is they were actually turning away business from these large clients not because they didn’t have the room in their kitchen or the ability to make the food. It was because they didn’t have the drivers.”

For individual meals, restaurants know exactly when they’ll be most busy—dinner, lunch, maybe breakfast—and can staff accordingly. With catering, Sukumaran says, “There’s a very unpredictable nature to this demand. You might get three catering orders one day and you might get 10 the next day. What a lot of these folks are doing are essentially repurposing their store managers or their kitchen staff to run outside, grab a van, and drive the order across town.”

That was an opportunity for DoorDash, which already knows how to deploy delivery services in just-in-time form. Furthermore, just as DoorDash helps restaurants be more efficient, restaurants could improve DoorDash’s own efficiency by providing it with catering orders to deliver during off-peak hours.

“The reason that every restaurant doesn’t just employ a fleet of people to sit around and drive is because demand varies so much by day and by week,” says Sukumaran. “We are trying to smooth out that demand, and we’re trying to do it efficiently. By efficiently, I mean that we need to be able to maximize the Dasher’s ability to earn—which means you can’t be idle a lot of the time—while maintaining very high reliability.”

As DoorDash formulated plans for Drive, the company “reached out to some of our larger restaurants and said, ‘Would you be interested in access to the DoorDash driver network?,'” says Sukumaran. “They said “Hell yes, and twice on Sundays!'”

The large restaurants in question were ones that already had systems in place for catering deliveries, so their most immediate need was a way to handle overflow orders they might not otherwise be able to accept. “Over time, when they saw that our fulfillment quality was up to par, they started to send more and more orders our way,” Sukumaran says.

Trish Giordano, executive VP of sales and marketing for the Buca di Beppo and Earl of Sandwich restaurant chains, says that their catering businesses for corporate clients have exploded in recent years. At the same time, however, it’s become increasingly tough to find drivers, as Uber and Lyft have drained the pool of potential hires. During its pilot period, DoorDash Drive has allowed her eateries to expand their catering capacity without staffing up. “Now instead of 2-3 orders a day, we can take 10-15 areas a day,” she says.

During this trial phase, DoorDash has gamely tweaked the service to hit the level of professionalism Giordano wants to see—such as ensuring that Dashers wear collared shirts. “They’ve worked with us and their city managers to train their staff and fulfill our expectations,” she says. She plans to stick to on-staff delivery people for VIP customers, but is looking forward to calling on Drive to help deal with the impending crunch of holiday orders.

Los Angeles-based Coolhaus has been using Drive to fulfill smaller bulk orders of its gourmet ice cream sandwiches—50 or 60 at a pop versus the 300 or more it handles using its own staffers. Again, DoorDash adjusted the relationship based on Coolhaus’s needs—which, it turned out, involved the company wanting Dashers to avoid contacting its customers directly. “For our clients, it’s not DoorDash delivering, it’s us having it delivered,” says Craig Gladstone, the company’s director of operations. “That was a learning for both of us.”

“Right now, DoorDash is generating a lot of incremental business for our merchants, but what Drive does allows us to touch every delivery that leaves a merchant,” Xu says. “Whether it originated on DoorDash or off DoorDash.” Restaurants currently schedule a Drive pickup on the DoorDash website; soon, they’ll also be able to do so with the app that they use to manage standard DoorDrive orders. Unlike single-meal transactions, catering orders don’t involve DoorDash handling the payment transaction between restaurant and customer. It charges the restaurant a fee that includes a base fee and a percentage of the order’s cost.

Though DoorDash built Drive with catering in mind, it also hopes merchants will use it for other types of volume food delivery. Los Angeles-based Greenleaf Gourmet Chopshop, for instance, turned to the service to deliver salads to Equinox gyms, where they’re sold as “grab n’ go” items. Coolhaus’s Gladstone says that he’d consider using Drive for deliveries to retail stores as well as corporate clients at some point: “I’d have to have 100% confidence before I hand them our wholesale business, but I know it’s something they want.”

Opening Up Drive

Much of what DoorDash has already built lends itself to Drive without major modification. I wondered if fulfilling catering orders required the company to find delivery people who own great big trucks. (Dashers are contractors who provide their own vehicles.) So far, Sukumaran told me, the quantities of food involved fit into garden-variety passenger vehicles.

But the more ambitious Drive gets, the more functionality that DoorDash will need to create with it in mind. To deeply integrate the service into their way of doing business, restaurants—especially large chains—will want to meld it with other tools they use, such as call-management software. DoorDash’s plan is to make that possible, at first by working closely with a few partners who provide those sorts of apps. Eventually, however, it wants to turn its software platform and platoons of Dashers into what Sukumaran calls “a programmatically accessible logistics network” that lets other companies meld Drive functionality with their own wares. “The goal is that this infrastructure becomes something that you can build other things on top of,” he says.

Eventually, the things that people build on top of the Drive infrastructure could involve the transport of almost anything within a city. “Long term, we always knew that DoorDash would be a fulfillment network like a UPS or FedEx for the last mile within an urban context for many, many different things—not just food,” stresses Sukumaran. “I think DoorDash Drive is step one in the direction of having the DoorDash platform fulfill more than just food. Maybe it’s step 0.1. It’s really, really early on.”

“We absolutely have plans to expand into other categories,” adds Xu. “But I’ve always believed that you have to get one thing right before you earn the opportunity to do that second thing.”

Even just in the domain of edibles, DoorDash still has possibilities left to explore. Besides introducing Drive, the company is rolling out delivery of alcoholic beverages—hey, cold beer!—and has begun fetching prepared foods, snacks, and beverages from Whole Foods, a move that amounts to tiptoeing in the direction of the grocery-delivery business.

And as quickly as DoorDash has built out its logistics network, there are still plenty of cities yet to be streamlined. “There are a lot of markets even in North America that we haven’t yet reached and we’ll be launching,” says Xu. “One of the things we’ve learned is just how consistent the need is from city to city. Everyone, shockingly, wants convenience. And as a result, it’s our job to find the ways to fulfill that.”

Fast Company , Read Full Story

(25)