Very Human Lessons From Three Brands That Use Chatbots To Talk To Customers

Remember when “there’s an app for that” was a popular refrain? Now, as consumers’ smartphones fill up with apps they’ve only used a handful of times and businesses try to reach consumers while they’re online, the zeitgeist has shifted to “there’s a bot for that.”

Chatbots—which use artificial intelligence to converse with users—are particularly popular. Facebook unveiled its bots for Messenger Platform in April, allowing businesses to communicate with its users through chatbots (under certain parameters) right in an interface that billions of people already use. Even the White House Facebook page has a chatbot that walks people through the process of sending questions or feedback to President Obama. Outside of Facebook, other chat platforms, including Microsoft and Kik, provide other engagement opportunities.

Given the limitations of artificial intelligence (see: Microsoft’s Tay spouting racist epithets a day after launch) chatbots aren’t a one-size-fits-all proposition. But some brands have managed to use them successfully to engage customers.

Give Really Helpful Recommendations

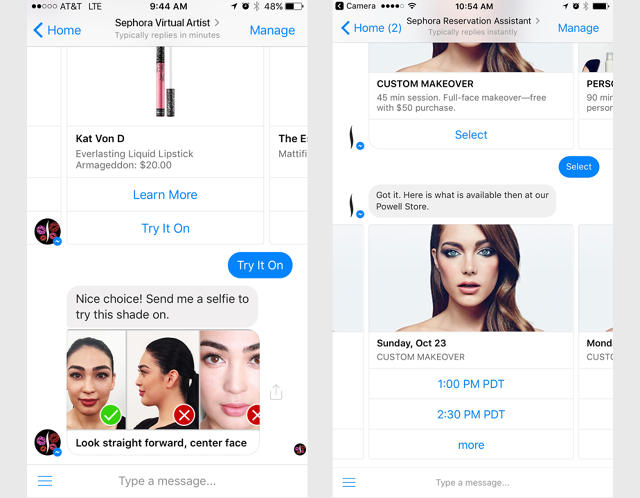

Riding a wave of one such success story, beauty brand Sephora is launching two new chatbots on Facebook Messenger. This is in addition to its existing bots on Facebook Messenger and Kik. One called the “Sephora Reservation Assistant,” lets users book or edit a makeover appointment through Facebook Messenger. The other is a shade-matching chatbot that can identify lip colors to match photos uploaded by users.

Sephora’s first foray into chatbots was a bot launched on messaging app Kik in March. “With Kik, it was really about leveraging our library of how-to content that brings together things like video and images and text tips to our client on Kik in a quiz-like interface,” says Mary Beth Laughton, senior vice president of digital for Sephora. “We recommend relevant content based on their interests.” Laughton says they also saw Kik as an opportunity to acquire young clients who are on Kik and meet existing clients where they’re already spending their time.

“We’re finding that once a Kik user starts a conversation with our Sephora bot, they’re engaging deeply, averaging 10 messages with our Sephora bot per day,” Laughton adds. Targeted push notifications to those Kik users encourages them to view new content. Laughton says those notifications have a high open rate but declined to give a specific number.

“By nature, Sephora chatbot users will have a logged cadence of questions, because of how the platform services their inquiries,” Laughton explains, “whereas speaking with our in store experts (which can also be question driven) tends to be more conversational because of the educational services and environment we offer.” Laughton says they’re not comparing the interactions, rather she says it’s about solving the clients needs, no matter where they are.

The beauty brand also has a Facebook chatbot called the Sephora Virtual Artist that allows users to upload a selfie and try on different lip colors. The current Facebook chatbot and the virtual artist on Sephora’s mobile app has received over four million visits, with over 90 million shades tried on, according to Laughton. “We know our clients love to engage with the virtual try-on,” she says.

Building off this popularity, Sephora’s new shade-matching chatbot helps users locate a Sephora lip color that matches the color in a photo they’ve uploaded, then lets them try on that lip color using the Sephora Virtual Artist. Once they’ve chosen a product, the bot directs them to the Sephora website for purchase.

Meanwhile, Sephora Reservation Assistant, the other Facebook bot launching this week, uses natural language processing to book makeover appointments. “If they put in the shorthand for a city or a combination of date and time, [the chatbot] can figure that out,” Laughton says. Later on, the company plans to expand into bot-based bookings for classes.

Through Sephora’s existing Facebook bot and its interactions on Kik, Laughton says they’ve learned the importance of providing guidance to users on how to interact with the bot. “Suggesting a way that they could respond—for example, you could say ‘pink’—helps [the bot] provide the most useful reply,” she says. “We’re definitely in the test and learn phase,” says Laughton, “but are encouraged by the early results. What’s great is we can use different chatbots to have different types of varied rich conversations.”

Make Troubleshooting Invisible

Expensify offers a tool that automates expense reports and reimbursement for companies including Uber, Warby Parker, and Virgin Hotels. The company began rolling out a chatbot called “Concierge” late last year and has been gradually adding more functionality. Users can opt out of Concierge, but CEO David Barrett says very few people do. In fact, some users may not realize they’ve interacted with Concierge.

“Every time you think of us, that means we did something wrong,” Barrett says. “Great customers don’t even realize they’re using Expensify. The primary purpose is to make our product disappear.”

Some consumer brands like Sephora measure the success of a chatbot by the frequency or length of user interactions. But for a chatbot like Concierge, whose role is to trouble-shoot before a customer notices a problem, “you don’t want to talk to the chatbot, you want something to happen with the minimum amount of interaction,” Barrett says.

Concierge can communicate with Expensify users on the website and through mobile, with plans to add Slack integration in the future. “Wherever you are, that’s where it’s going to find you,” Barrett says.

For instance, Concierge walks new users through the setup process and if the connection between users credit cards and Expensify breaks, the chatbot will give users instructions on fixing that connection before it becomes a problem. The bot also has access to real-time pricing on flights, hotels, and other travel. It notifies users if they’re getting the best value.

Concierge has helped reduce banking problems by 75%, Barrett asserts, and points out that adding Concierge to the website has quintupled the number of free trials. While not in the same league as someone who immediately clicks “buy,” says Barrett, a “quite good” number of these free trial browsers do convert buyers.

Even as Concierge takes on more functions, Barrett is careful to keep the user interface simple. “People don’t want more functionality, they already have too much functionality,” he says. “With more apps and buttons and icons, it’s just too much power in one little device,” Barrett contends. “The most modern applications today are about having less UI, a single button that does a tremendous amount of stuff for you.”

Aggregate Daily Drudgery

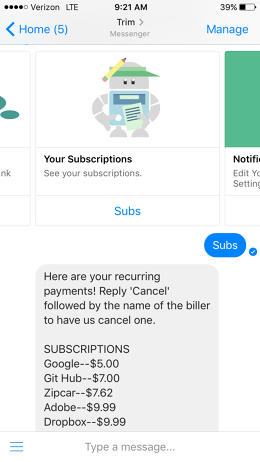

Fintech startup Trim launched last November as a SMS-based chatbot. Users sign up and register their credit cards, then Trim scans their bills for recurring subscription charges. In the SMS-based iteration, Trim texts users asking if they want to cancel a subscription and then Trim handles the cancellation process for them. Earlier this year, Trim added a Facebook Messenger bot, becoming one of Facebook’s first featured bots.

Now Trim can also answer user’s questions about balances or recent transactions rather than log into their bank or credit card account to check. “We think that the subscription-tracking and cancelling use case is a great hook, but it doesn’t happen very often,” says cofounder and CEO Thomas Smyth. “We see significantly higher engagement by helping folks with the humdrum, day-to-day of personal finance.”

While some other brands invest significant effort into giving chatbots a personality, Smyth says that, like Expensify, Trim has deliberately steered in the opposite direction, favoring simplicity over personality. “We believe that when people engage with personal financial questions, they do not want to have a conversation, they want an answer,” he says. “We’ve designed our user experience to be much more about how can we enable you to access that information as quickly as possible.” To that end, users can type the word “balance” to view their balance or “recent” to see recent transactions.

While users can get these kinds of notifications directly from financial institutions, Smyth says Trim “make[s] it easier to control and fine-tune your notifications with a simple dashboard” that aggregates all of your accounts in one place.

The simple approach seems to be working. Trim has a 94% retention rate, according to Smyth. He says people use Trim on an ongoing basis for the active queries mentioned above (balance or recent transactions) and passive notifications about large charges on their card, large deposits, late fees, and overdraft fees.

Trim would not disclose specific stats on engagement, but Smyth says the company’s Facebook Messenger has higher engagement than SMS. “It’s hard at this point to disentangle whether this is the user base or the platform,” he admits, but intuitively the Messenger platform is far better suited to significantly better engagement.”

Fast Company , Read Full Story

(55)